Veneer Breakthroughs: Microfluidic Biomedical Devices Set for Explosive Growth Through 2029 (2025)

Table of Contents

- Executive Summary & Market Highlights (2025–2029)

- Key Technology Trends in Veneer Materials for Microfluidics

- Current State of Microfluidic Biomedical Device Veneers: 2025 Benchmark

- Major Players & Strategic Partnerships (Citing Company Websites)

- Market Size, Segmentation & 5-Year Forecasts

- Emerging Applications: Diagnostics, Drug Delivery, and Beyond

- Regulatory Landscape & Industry Standards (e.g., FDA, ISO, IEEE)

- Manufacturing Innovations: Scalability, Sustainability, and Cost

- Challenges & Barriers to Adoption: Technical and Commercial

- Future Outlook: Disruptive Opportunities, R&D, and Investment Hotspots

- Sources & References

Executive Summary & Market Highlights (2025–2029)

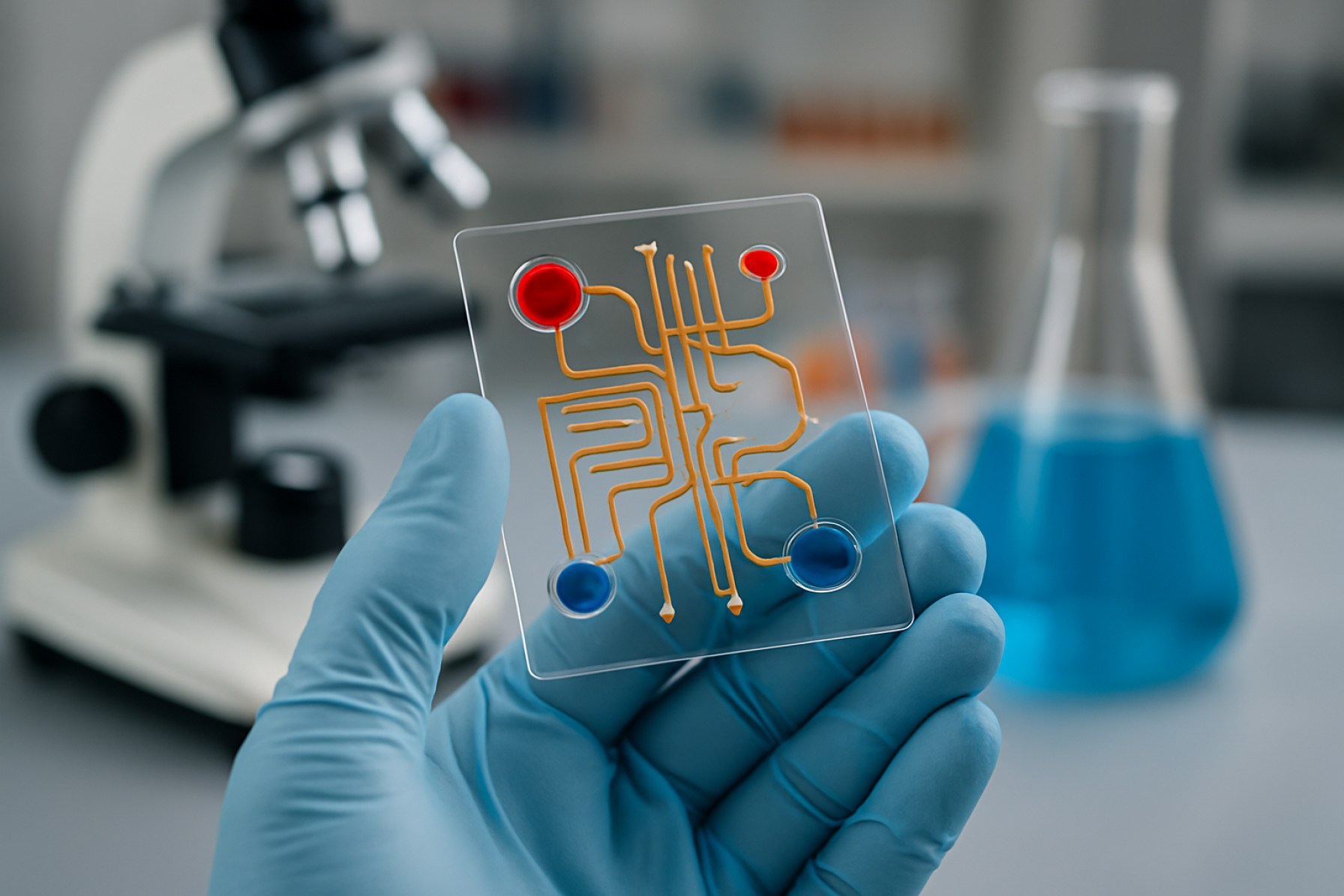

The global market for microfluidic biomedical devices is experiencing rapid innovation, with veneer materials and development processes emerging as a critical area of focus through 2025 and into the late 2020s. Veneers—thin, functional surface layers applied to microfluidic substrates—play a key role in ensuring device biocompatibility, enhancing sensitivity and specificity, and enabling mass manufacturability at scale. The adoption trajectory of advanced veneer solutions is being propelled by the demand for point-of-care diagnostics, lab-on-chip platforms, and personalized medicine applications.

In 2025, leading device manufacturers are intensifying R&D into high-performance veneer materials such as cyclic olefin copolymer (COC), polydimethylsiloxane (PDMS), and innovative surface coatings. Companies like Dolomite Microfluidics and microfluidic ChipShop are actively developing proprietary processes for veneer deposition and bonding, focusing on scalable production with precise control over surface properties. These efforts are aimed at meeting the stringent requirements of biomedical assays, including low nonspecific binding and chemical resistance.

Recent years have seen a transition from traditional glass and silicon base materials to advanced polymers with functionalized veneers, offering not only cost advantages but also improved optical clarity and customizable surface chemistries. In 2025, ZEON Corporation continues to expand its ZEONEX and ZEONOR COC product lines to meet demand for ultra-low autofluorescence in diagnostic microfluidics. Meanwhile, Nordson MEDICAL is collaborating with device developers to integrate plasma, UV, and chemical modification techniques for tailored surface functionalization.

The market outlook through 2029 anticipates accelerated adoption of veneer-enhanced microfluidic devices in liquid biopsy, infectious disease screening, and organ-on-chip models. Regulatory acceptance is advancing, as evidenced by increased FDA clearances for polymer-based, veneered microfluidic components in 2024 and 2025. This trend is expected to spur further investment from both established medtech firms and startups, with modular veneer platforms enabling rapid prototyping and faster time-to-market.

- Surging demand for integrated, ready-to-use microfluidic chips is driving partnerships between material suppliers and OEMs.

- Veneer technologies that ensure low-cost, high-volume manufacturability—without compromising assay reliability—are projected to dominate procurement decisions.

- Expanding applications in genomics, cell sorting, and wearable biosensors are catalyzing the need for next-generation surface engineering solutions.

In summary, veneer development is shaping the next wave of microfluidic biomedical innovation, supporting both the scalability and functionality required for the expanding diagnostics and life sciences market over the coming years.

Key Technology Trends in Veneer Materials for Microfluidics

Veneer development for microfluidic biomedical devices is rapidly advancing, with a focus on improving material performance, biocompatibility, and manufacturability. The year 2025 is poised to see several key technology trends that will shape the sector over the next few years.

- Emergence of Advanced Polymers and Composites: Polymeric veneers remain the material of choice due to their flexibility, optical transparency, and ease of processing. New formulations, such as cyclic olefin copolymers (COC) and cyclic olefin polymers (COP), are being adopted for their low autofluorescence and high chemical resistance, crucial for diagnostic and point-of-care devices. Leading suppliers like TOPAS Advanced Polymers and ZEON Corporation are expanding their product lines to meet demand from microfluidics developers.

- Shift Toward Bio-based and Sustainable Veneers: Environmental concerns and regulatory pressures are driving research into biodegradable and bio-based materials, such as polylactic acid (PLA) and cellulose derivatives. Companies including NatureWorks LLC are actively promoting PLA for medical microfluidic applications, highlighting its potential for single-use and disposable devices.

- Enhanced Surface Modification Technologies: Functionalization of veneer surfaces—via plasma treatment, UV activation, or chemical grafting—enables improved bonding, wettability, and integration of bioactive molecules. Dyne Technology and 3M are among companies offering surface treatment solutions tailored for microfluidics manufacturing, supporting both prototyping and scale-up.

- Integration with Roll-to-Roll and High-Throughput Manufacturing: To address scalability, there is a marked trend towards roll-to-roll (R2R) lamination and continuous processing of veneer layers. This approach, championed by companies like Micro Systems Technologies, promises to reduce costs and enable mass production of diagnostic cartridges and lab-on-chip devices.

- Optical and Electronic Integration: As microfluidic devices increasingly incorporate on-chip detection, there is a push for veneer materials compatible with embedded optical waveguides, electrodes, and even flexible electronics. Corning Incorporated is developing glass and hybrid substrates that combine the advantages of polymers and traditional glass for advanced biomedical applications.

Looking ahead, the microfluidic biomedical device industry will continue to prioritize veneers that offer high precision, sustainability, and compatibility with diagnostic workflows. Collaborations between material suppliers, device manufacturers, and end-users are expected to accelerate the adoption of next-generation veneer technologies by 2026 and beyond.

Current State of Microfluidic Biomedical Device Veneers: 2025 Benchmark

As of 2025, veneer development for microfluidic biomedical devices is characterized by a rapid evolution in materials science, fabrication techniques, and integration capabilities, driven by the increasing demand for high-performance, miniaturized diagnostic and therapeutic platforms. Veneers—referring to the thin, functional layers that form the interfacing and protective surfaces of microfluidic devices—play a critical role in device biocompatibility, chemical resistance, and optical clarity.

Recent advancements have focused on expanding the range of functional materials used as veneers. Polydimethylsiloxane (PDMS) remains a mainstay due to its optical transparency and elasticity, but its limited chemical resistance and potential for small molecule absorption have led to a surge in alternatives such as cyclic olefin copolymers (COC), poly(methyl methacrylate) (PMMA), and glass. Companies like Dolomite Microfluidics and Microfluidic ChipShop offer a variety of veneer materials tailored for specific biomedical applications, with COC and PMMA gaining traction in commercial products for their superior solvent resistance and lower autofluorescence.

The industry is also witnessing the integration of advanced surface modifications into veneers to improve device performance. Surface coatings that resist protein fouling or enable selective binding of biomolecules are increasingly incorporated during manufacturing. For example, Corning Incorporated has introduced specialized coatings for glass-based microfluidic chips, enhancing both wettability and biocompatibility. Similarly, Zeon Corporation is promoting ZEONEX and ZEONOR polymers, which provide low fluorescence backgrounds and can be functionalized for specific assay requirements.

From a manufacturing perspective, 2025 benchmarks show a growing adoption of scalable processes such as injection molding, hot embossing, and roll-to-roll fabrication for veneer layers, enabling consistent high-volume production. These methods have been successfully implemented by Invenio Systems and Helvoet Rubber & Plastic Technologies, facilitating cost-effective production of highly precise microfluidic devices.

Looking ahead, the next few years are expected to bring further innovation in smart and responsive veneer materials that can dynamically interact with biological samples or adjust surface properties on-demand. Additionally, with the continued miniaturization and multiplexing of microfluidic biomedical devices, the precision and multifunctionality of veneers will remain a central focus for both established manufacturers and emerging startups.

Major Players & Strategic Partnerships (Citing Company Websites)

As the demand for advanced microfluidic biomedical devices grows, several major players are driving innovation in veneer development—offering thin, functional layers tailored for precise fluid handling, biocompatibility, and manufacturability. In 2025, the sector is marked by robust investments, new material launches, and a strategic emphasis on collaborative partnerships to accelerate commercialization and address regulatory hurdles.

- Röchling Group remains a key innovator, leveraging its expertise in high-performance thermoplastics to produce sophisticated microfluidic substrates and veneers for diagnostics and life sciences. Röchling’s Medical division has expanded its production capabilities, focusing on laser-structured and multi-layered films that offer precise fluidic control and chemical resistance—critical aspects for next-generation biomedical chips.

- Microfluidic ChipShop has strengthened its partnerships with device manufacturers and research institutes to co-develop application-specific veneers. Their substrate materials portfolio now includes customizable polymer films tailored for optical clarity and surface modification, supporting the rapid prototyping of custom diagnostic devices.

- DuPont continues to play a pivotal role through its Healthcare & Medical Devices division, offering specialty films and adhesives designed for integration into microfluidic systems. In 2025, DuPont is expanding its collaborative efforts with both start-ups and established OEMs, aiming to accelerate the scale-up of innovative veneer solutions that meet stringent biocompatibility and performance requirements.

- Zeon Corporation is advancing the field with its ZEONEX and ZEONOR cyclo olefin polymer films, which have become industry standards for microfluidic device veneers due to their low autofluorescence and high chemical resistance. Zeon is actively engaging in joint development agreements with biomedical device makers to create new generations of microfluidic platforms for point-of-care applications.

- Strategic Outlook: The next few years will see intensified collaboration between material suppliers, device integrators, and research institutions. Companies are expected to focus on the co-development of functionalized veneers—incorporating antifouling coatings, integrated sensors, or smart surfaces. Cross-industry alliances and early engagement with regulatory agencies will be critical to accelerate time-to-market, particularly for devices targeting personalized medicine and rapid diagnostics.

Market Size, Segmentation & 5-Year Forecasts

The market for veneer development in microfluidic biomedical devices is poised for robust growth as microfluidics continues to drive innovation in diagnostics, therapeutics, and life sciences research. Veneers—in this context, thin, functional surface layers or coatings engineered to enhance microfluidic device performance—are being increasingly adopted to address challenges in biocompatibility, optical clarity, chemical resistance, and manufacturability.

As of 2025, the global microfluidics market is estimated to reach approximately USD 35 billion, with a significant portion attributable to biomedical applications such as point-of-care diagnostics, lab-on-chip systems, and organ-on-chip models. Within this ecosystem, demand for advanced functional veneers is rising, as device manufacturers seek to optimize fluid flow, prevent nonspecific adsorption, and enable integration of sensing elements. Key materials include thin polymeric films (such as cyclic olefin copolymer and polydimethylsiloxane), as well as bioactive and anti-fouling coatings. Companies like Dolomite Microfluidics and microfluidic ChipShop are actively developing and commercializing microfluidic substrates and surface engineering solutions tailored for biomedical applications.

Market segmentation in the veneer development space can be delineated by material (polymers, glass, silicon, specialty coatings), application (diagnostics, drug discovery, cell biology, environmental monitoring), and end-user (hospitals, research institutes, pharmaceutical companies). Polymer-based veneers, owing to their scalability, cost-effectiveness, and customizable surface properties, are projected to maintain dominance, particularly for single-use diagnostic cartridges. The Asia-Pacific region is expected to witness the fastest growth due to expanding healthcare infrastructure and investments in biotechnology, with regional manufacturers such as ZEON Corporation (specializing in cyclo olefin polymers) scaling up supply for biomedical device integration.

Over the next five years, the veneer development segment is anticipated to grow at a compound annual growth rate (CAGR) exceeding 12%, outpacing the broader microfluidics market. This acceleration is driven by the surge in demand for rapid diagnostics (including infectious disease testing and personalized medicine), regulatory emphasis on device safety and reliability, and ongoing advances in surface modification techniques. The outlook is further bolstered by collaborations between material science innovators, device manufacturers, and end-users to co-develop next-generation microfluidic solutions. For instance, Corning Incorporated continues to expand its advanced glass and coating technologies for life sciences and clinical diagnostics, supporting the evolving needs of microfluidic device developers.

Emerging Applications: Diagnostics, Drug Delivery, and Beyond

The development of advanced veneer materials for microfluidic biomedical devices is poised to significantly enhance device performance and broaden their application scope, especially in diagnostics and drug delivery, over the next several years. Veneers—thin protective or functional layers integrated onto microfluidic chips—play a crucial role in modulating surface chemistry, improving biocompatibility, and enabling functionalization for specific biomedical assays.

In 2025, manufacturers are increasingly deploying polymeric and hybrid veneer coatings to address longstanding challenges such as protein adsorption, non-specific cell adhesion, and chemical instability. Companies like Dolomite Microfluidics are developing proprietary surface treatments and coatings to provide anti-fouling properties and enhance device robustness for repetitive biomedical assays. These advances are pivotal in point-of-care diagnostics, where consistent performance and minimal sample loss are paramount.

Emerging applications also leverage veneers for advanced biofunctionalization. For example, Standard BioTools (formerly Fluidigm) incorporates specialized surface chemistries to immobilize capture antibodies and oligonucleotides on chip surfaces, facilitating highly sensitive immunoassays and nucleic acid tests. This approach is particularly relevant for single-cell analysis and multiplexed diagnostics, where precise control over microenvironmental conditions is essential for assay fidelity.

In drug delivery, veneer innovation supports the development of organ-on-chip and drug screening platforms. Emulate, Inc. utilizes proprietary surface coatings on their Organ-Chips to mimic extracellular matrix properties, allowing for more physiologically relevant cell behavior and drug response. These functional veneers not only enhance the predictive value of preclinical studies but also support the integration of microfluidics into pharmaceutical workflows.

Looking ahead, the convergence of micro- and nano-fabrication is expected to yield multifunctional veneers with stimuli-responsive capabilities—such as tunable wettability or on-demand drug release. Companies like AIT Austrian Institute of Technology are exploring smart polymer coatings that respond dynamically to pH, temperature, or biomarkers, opening new avenues for real-time biosensing and personalized medicine.

As microfluidic biomedical devices become increasingly integral to clinical diagnostics, drug discovery, and emerging fields like cell therapy manufacturing, the refinement of veneer technologies will be a key enabler of device functionality, reliability, and scalability in 2025 and beyond.

Regulatory Landscape & Industry Standards (e.g., FDA, ISO, IEEE)

As microfluidic biomedical devices evolve, the regulatory landscape surrounding veneer materials—thin functional layers applied to device surfaces—has become increasingly stringent and standardized. In 2025, the United States Food and Drug Administration (FDA) continues to play a pivotal role, with its Center for Devices and Radiological Health (CDRH) enforcing premarket notification (510(k)), de novo, and premarket approval (PMA) pathways. Veneers intended for contact with biological samples are specifically scrutinized for biocompatibility and leachables, as per ISO 10993 standards, which the FDA has formally recognized for biological evaluation of medical device materials.

The International Organization for Standardization (ISO) has further shaped veneer development through updates to ISO 13485 (medical device quality management systems) and ISO 14644 (cleanroom standards), both of which guide the manufacturing of laminates and surface films for microfluidic substrates. ISO 13485:2016, in particular, mandates traceability and documentation for raw materials and surface treatments, a requirement that directly impacts suppliers of specialty polymers and adhesives used as veneers.

In parallel, the IEEE 2700-2017 standard—covering sensor performance in biomedical devices—has seen increased adoption for microfluidic systems, with a focus on the stability and non-interference of functional coatings. The IEEE is expected to release updates by 2026, reflecting the growing prevalence of integrated sensor-veneer assemblies and emerging material classes such as parylene-C and fluoropolymers.

Industry stakeholders like Dow and DuPont continue to collaborate with regulatory bodies, providing compliance documentation and testing data for their surface-engineered films. This collaboration is essential, as regulatory authorities increasingly require pre-submission meetings to clarify testing protocols for new veneer chemistries or nanoengineered surfaces.

Looking ahead, regulators are expected to tighten requirements for data transparency, especially concerning extractables and endotoxin contamination from veneers. With the anticipated release of ISO/TR 21702 (guidance on antiviral surface properties) and further refinement of ISO 10993 parts, developers will face higher expectations for both risk assessment and real-world performance validation. These trends underscore the need for early and sustained regulatory engagement throughout the veneer development process for microfluidic biomedical devices.

Manufacturing Innovations: Scalability, Sustainability, and Cost

The evolution of veneer development for microfluidic biomedical devices is rapidly advancing, driven by demands for scalable, sustainable, and cost-effective manufacturing solutions. Veneers—ultra-thin, often functionalized layers—play a critical role in the precise fluid manipulation, biocompatibility, and sensor integration needed for next-generation lab-on-chip diagnostics and therapeutic systems.

In 2025, microfluidic device manufacturers are increasingly prioritizing scalable production methods for veneer layers, with a shift from traditional silicon and glass substrates toward polymeric and hybrid materials. Thermoplastics such as cyclic olefin copolymer (COC) and polydimethylsiloxane (PDMS) are being adopted for their ease of processing, chemical resistance, and lower cost. ZEON CORPORATION and Nippon Zeon Co., Ltd. are notable suppliers offering COC and COP grades specifically engineered for microfluidic veneer applications. These polymers are compatible with high-throughput manufacturing techniques like injection molding and roll-to-roll processing, which are expected to dominate the market in the near term due to their scalability and reduced per-unit cost.

Sustainability is another major focus area. Companies are exploring bio-based and recycled materials for veneers to reduce environmental impact. For instance, SABIC is advancing bio-based polycarbonate and other sustainable polymers suitable for biomedical microfluidics. Furthermore, solvent-free lamination and adhesive bonding methods are being developed to minimize chemical waste and energy consumption during veneer attachment.

Precision and quality control in veneer manufacturing are also evolving. DuPont and DSM are developing advanced photolithographic and surface-modification techniques to functionalize veneers in-line, enabling integration of biosensing and anti-fouling properties without additional process steps. Such innovations reduce costs and facilitate mass production.

Looking forward, the outlook for veneer development in microfluidic biomedical devices is characterized by continued integration of sustainable materials, automation-driven scalability, and functional versatility. As the demand for point-of-care diagnostics and personalized medicine grows, manufacturers are expected to further optimize veneer materials and processes for rapid prototyping, regulatory compliance, and seamless device assembly. Collaborative efforts between material suppliers and device fabricators will likely accelerate the commercialization of next-generation microfluidic systems with enhanced performance, cost-efficiency, and sustainability.

Challenges & Barriers to Adoption: Technical and Commercial

The development and adoption of veneer materials for microfluidic biomedical devices face several technical and commercial challenges as the sector moves through 2025 and into the next few years. While the promise of advanced veneers—thin, functional coatings or films applied to microfluidic substrates—offers significant improvements in biocompatibility, chemical resistance, and sensor integration, multiple barriers must be addressed for widespread commercialization.

Technical Challenges

- Material Compatibility and Performance: Achieving optimal adhesion and stability of veneer layers on a wide range of microfluidic substrate materials (such as PDMS, glass, or cyclic olefin copolymer) remains a persistent technical hurdle. Differential thermal expansion, surface energy mismatches, and swelling can lead to delamination or microcracking, impacting device reliability and reproducibility. Companies like Dolomite Microfluidics and Microfluidics International Corporation are actively researching new surface treatments and bonding techniques to mitigate these issues.

- Functional Integration: Veneers intended for biomedical microfluidics often need to incorporate multiple functionalities—such as selective permeability, anti-fouling properties, or embedded sensing elements. Integrating these features without compromising microchannel geometry or fluid dynamics is complex. Corning Incorporated is exploring hybrid material stacks and advanced patterning methods to enable multifunctional coatings while maintaining device performance.

- Scalability and Manufacturing: Transitioning from laboratory-scale processes (e.g., spin coating, vapor deposition) to scalable, reproducible manufacturing platforms is a key barrier. Uniformity of veneer thickness and properties across large batches is essential for regulatory compliance and commercial success. ZEON Corporation has invested in roll-to-roll processing and automated quality control for polymer films, aiming to address these scale-up challenges.

Commercial Barriers

- Cost Constraints: Advanced veneer technologies can add significant cost to microfluidic device production, especially when using specialty polymers or integrating nanomaterials. Cost-sensitive markets such as point-of-care diagnostics may be slow to adopt unless clear performance or regulatory advantages are demonstrated. Danaher Corporation is focusing on value-engineering and supply chain optimization to lower material and fabrication costs.

- Regulatory and Standardization Issues: Introducing new veneer materials or processes triggers additional regulatory scrutiny, particularly regarding biocompatibility and stability in clinical environments. The lack of industry-wide standards for veneer characterization further complicates validation and acceptance. Organizations such as ISO/TC 48 are working on developing standards for microfluidics, which are expected to facilitate regulatory alignment in the coming years.

Looking ahead, resolving these challenges will likely require coordinated advances in materials science, process engineering, and regulatory frameworks, enabling more robust, cost-effective, and compliant veneer solutions for biomedical microfluidics.

Future Outlook: Disruptive Opportunities, R&D, and Investment Hotspots

Looking ahead to 2025 and the following years, veneer development for microfluidic biomedical devices is poised for significant transformation, propelled by advances in materials science, fabrication technologies, and heightened investment in personalized healthcare. The veneer—the ultrathin functional layer that interfaces with biological or chemical samples—remains a focal point for innovation, enabling devices with improved sensitivity, biocompatibility, and integration with electronic systems.

One major disruptive opportunity lies in the adoption of next-generation polymers and hybrid materials. Companies such as Dow and Zeon Corporation are actively developing advanced cyclo-olefin polymers (COP) and copolymers (COC) with improved optical clarity, chemical resistance, and ease of surface modification. These materials enable thinner, more robust veneers tailored for high-throughput diagnostics and organ-on-chip platforms.

Surface functionalization remains a hotbed for R&D investment. For example, DuPont is exploring plasma and UV-based surface treatments to enhance hydrophilicity and selective biomolecule attachment, critical for point-of-care diagnostics with high specificity. Meanwhile, Corning Incorporated is developing proprietary glass veneer layers with engineered micro- and nano-scale textures to optimize fluid dynamics and cell adhesion.

In the realm of device fabrication, additive manufacturing and roll-to-roll processing are emerging as investment hotspots. 3D Systems and Roland DG are investing in precision 3D printing and digital fabrication methods that enable rapid prototyping and scalable production of complex veneer geometries. This trend is expected to lower costs and accelerate the translation of microfluidic innovations from the lab to commercial markets.

- Increased funding for personalized diagnostics and wearable biosensors is expected to drive demand for user-friendly, skin-conformal veneers, with Nitto Denko Corporation focusing on flexible, adhesive interfaces suitable for continuous monitoring.

- Collaborative R&D between device makers and material suppliers is accelerating the integration of smart, functionalized veneers with embedded electronics, such as those pursued by SCHOTT AG.

As regulatory bodies begin to address the unique challenges of microfluidic veneer materials, the next few years are likely to witness more standardized protocols, supporting faster adoption. The convergence of material innovation, digital manufacturing, and healthcare demand marks veneer development as a dynamic frontier for disruptive growth and investment within microfluidics.

Sources & References

- Dolomite Microfluidics

- microfluidic ChipShop

- ZEON Corporation

- Nordson MEDICAL

- TOPAS Advanced Polymers

- NatureWorks LLC

- Invenio Systems

- Helvoet Rubber & Plastic Technologies

- Medical division

- Healthcare & Medical Devices division

- ZEONEX and ZEONOR

- Emulate, Inc.

- AIT Austrian Institute of Technology

- ISO 13485

- Nippon Zeon Co., Ltd.

- DSM

- Microfluidics International Corporation

- 3D Systems

- Roland DG

- SCHOTT AG